|

Interbank market rates remain high

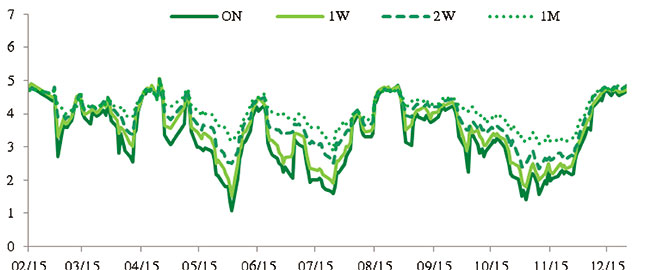

Interbank market rates rose steeply from November to December 2015. They reached a two-year peak at five per cent per annum, and remained high till the end of the year at rates that were the same as the borrowing cost of reverse repos via open market operations.

The main reason for the surge in interbank market rates was the high demand for short-term capital at the end of the year, illustrated by consecutive injections of money by the central bank, with substantial amounts added to the banking system and a high trading volume in the interbank market. Substantial credit growth and exchange rate fluctuations were leading reasons for a rise in demand for short-term loans, and due to huge purchases of government bonds the need for short-term capital to make bond-purchase payments also increased.

At the end of the year, the interbank market rates were quoted at: overnight (4.9 per cent), one week (5.0 per cent), two week (5.0 per cent), and one month (5.0 per cent). During 2015, the interbank market rates fluctuated widely between 1.1 and 5.0 per cent, wider than the rates’ movements in 2014, which were between 1.0 and 4.0 per cent.

High demand for short-term loans at the end of the year was demonstrated by large trading volumes in the interbank market and huge money injections by the central bank into the banking system in the last quarter of the year. Total trading volume in the fourth quarter reached VND1,601 trillion ($71.9 billion), up 20 per cent from the previous quarter and up 14 per cent compared with the same period last year. Due to rising demand for short-term capital, the central bank continuously injected money via open market operations – in December alone, the net injection volume was VND114.8 trillion ($5.16 billion), the largest monthly injection in 2015.

One of the main reasons for the rise in demand for short-term loans at the year’s end was credit growth, which by the end of the year had reached 17.17 per cent, significantly higher than the 12.62 per cent credit growth of 2014. Meanwhile, total deposits outstanding in 2015 grew at only 13.6 per cent, with the differential between deposit and credit growth resulting in demand for short-term loans to fund credit activities.

In addition, in December 2015, concerns over a further devaluation of the dong were once again raised before the Fed’s meeting, combined with increasing pressures on the Vietnamese currency towards the end of the year because of high demand for foreign currency to pay for import contracts. The central bank therefore sold USD to support VND; commercial banks also needed short-term funds to purchase foreign currencies to meet market demand.

There was also high demand for short-term capital to make bond-purchase payments; despite disappointing bond issuance in the first three quarters, government bonds attracted the attention of commercial banks in December as they replaced bonds that had come due, and short-term bonds with less-than-five-year maturities were offered again in the primary market. In December, the total monthly bond issuance amount reached a four-year high of VND63.15 trillion ($2.82 billion).

In 2016, we expect interbank market rates will continue to be impacted by exchange rate fluctuations. Although the new exchange rate mechanism will reduce demand for dollar speculation, exchange rates are predicted to increase further in 2016. Therefore, demand for the dollar will remain high.

In addition, credit growth is expected to be stronger than in 2015, at 18 to 20 per cent. The bond market will have high bond yield levels, meaning higher returns for investors and greater attraction for commercial banks. Meanwhile, banks will continue to resolve bad debts, sell debt to VAMC, and make high provisions for bad debts, which will reduce the banks’ sources of capital for credit activities, and bond investment will tighten. As a result, demand for short-term capital to meet credit growth will increase, and lead interbank market rates to rise.

vir

|