|

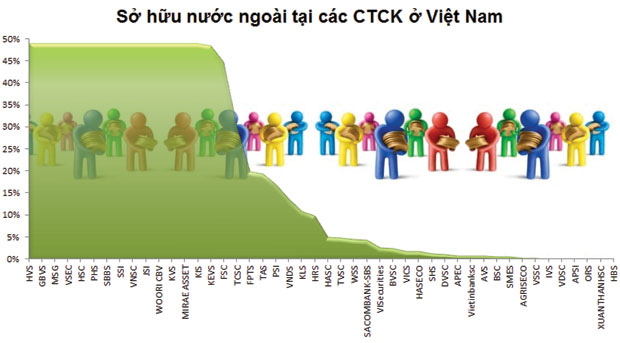

Foreign capital present at 50 securities companies

There are 46 foreign invested operational securities companies in Vietnam. Meanwhile, 100 percent foreign owned securities companies are expected to come out after the Ministry of Finance releases the circular on the establishment of 100 percent foreign owned securities companies.

Nearly 44 percent of securities companies have foreign capital

According to Dau tu chung khoan, which analyzed the released 2011 annual reports of 93 securities companies, 46 companies out of the 105 operational companies in Vietnam have foreign invested capital, accounting for nearly 44 percent.

As such, Vietnam now has only six more foreign invested companies than the last year. However, the foreign ownership ratios in the companies have increased significantly.

Of the 46 foreign invested securities companies, 13 have the 49 percent foreign ownership ratio, the highest possible ratio for foreign investors. Three companies have the foreign capital accounting for over 40 percent, while eight companies have the foreign capital ownership ratios of between 5-30 percent. Only 22 securities companies have low foreign ownership ratios of less than five percent.

In classifying the foreign invested securities companies in accordance with the chartered capital, the total capital contributed by foreign investor has reached 4510.13 billion dong, accounting for 19.7 percent of the total chartered capital of the 46 foreign invested companies, and 12.88 percent of the total chartered capital of the 105 existing companies in the market.

All the 27 listed securities companies have foreign capital. Of these, eight companies have the foreign ownership ratios of over 10 percent. Meanwhile, two of the companies, namely Golden Bridge Vietnam (GBS) and Phu Hung Securities Company (PHS), do not have more “room” for foreign investors, because the current foreign ownership ratio has hit the allowed ceiling.

The Saigon Securities Incorporated (SSI) and HCM City Securities Company (HCM) still can receive more foreign capital, but the room left for foreigners would be very limited, 2001 and 6 shares, respectively.

The total foreign invested capital accounts for 16.62 percent of the chartered capital of the 27 listed securities companies.

If calculating the value of the shares based on the share prices of August 3, the total capitalization value foreigners are holding in 27 listed securities companies would be 5,209.92 billion dong. The figure just amounts to only 3.73 percent of the total share value held by foreigners in 703 companies listing their shares on the two Hanoi and HCM City bourses.

The door opened widely for unlisted securities companies

Under the Decree No. 58 guiding the implementation of the Securities Law taking effects since September 15, 2012, foreign investors can contribute capital to set up securities companies in Vietnam under two modes. They either can buy stakes or contribute capital to possess 49 percent of the stakes of Vietnamese securities companies, or establish new securities companies where foreign investors contribute 100 percent capital.

Therefore, analysts believe that foreign investors would contact unlisted companies to buy the stakes to wholly possess the companies.

Of the 19 unlisted securities companies which have foreign investment capital, 12 companies have the high foreign ownership ratios of 44-48 percent. Analysts believe that the biggest changes would occur with the group of securities companies, after the Ministry of Finance turns the green light on foreign investors, allowing them to buy the remaining proportions of stakes.

Nearly 60 securities companies, which still do not have foreign capital and have small operation scale, could also be the targets for foreign investors.

DTCK

|