|

Positive earnings result expectations drive VN-Index to record high

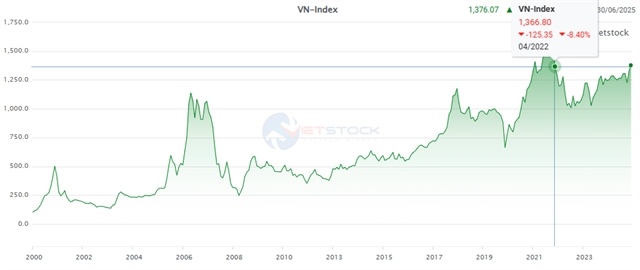

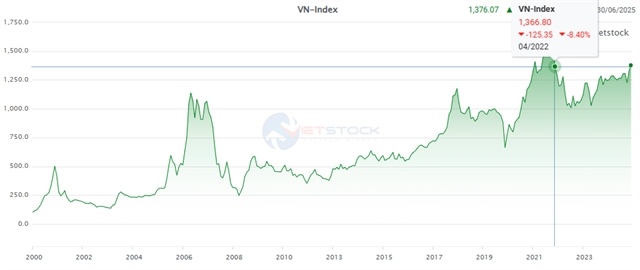

On the Ho Chi Minh Stock Exchange (HoSE), the VN-Index rose 4.63 points, or 0.34 per cent, to 1,376.07 points. This was its second consecutive peak after breaching the 1,270-point mark.

The industrial park built by Becamex in Bình Dương Province. The company's shares surged nearly 2 per cent on Monday, supporting the market's uptrend. — VNA/VNS Photo

|

Benchmark indices closed June on a positive note, with the VN-Index hitting the highest since April 2022 despite low liquidity.

On the Ho Chi Minh Stock Exchange (HoSE), the VN-Index rose 4.63 points, or 0.34 per cent, to 1,376.07 points. This was its second consecutive peak after breaching the 1,270-point mark.

The industrial park built by Becamex in Bình Dương Province. The company's shares surged nearly 2 per cent on Monday, supporting the market's uptrend. — VNA/VNS Photo

|

The breadth of the southern market was positive, with the number of gainers surpassing that of decliners by 216 to 92. However, liquidity remained low at VNĐ18.85 trillion (US$722.4 million).

The bullish trend was driven by large-cap stocks and expectations for the second quarter earnings results of listed companies.

The VN30-Index, which tracks the 30 biggest stocks in terms of market capitalisation on HoSE, also finished higher, up 1.67 points, or 0.11 per cent, to 1,477.56 points. In the VN30 basket, 16 ticker symbols went up while ten decreased and four stayed flat.

Some stocks saw impressive gains, such as Becamex (BCM) soared 1.9 per cent, Bao Viet Holdings (BVH) up 1.72 per cent, Vietnam International Commercial Joint Stock Bank (VIB) up 1.1 per cent and VietJet (VJC) up 1.03 per cent.

In contrast, Sabeco (SAB) declined by 1.26 per cent. Most stocks in the VN30 group fluctuated less than 1 per cent, reflecting cautious capital flows during this accumulation phase.

Sectors like banking, which has a significant impact on the VN-Index, posted positive performance. Fourteen banking stocks rose, while only six fell, providing strong support for the index's upward momentum.

In the afternoon session, the oil and gas sector rebounded, with Binh Son Refining and Petrochemical Company (BSR), PV Coating (PVB), PV Chem (PVC), PV Drilling (PVD) and PetroVietnam Technical Services Corporation (PVS) all closing higher. This surge reflects positive sentiment and expectations for rising global oil prices.

As the market expects the Q2 earnings announcements, MB Securities (MBS) forecasts that overall market profits could increase by about 14 per cent year-on-year, despite ongoing geopolitical risks and trade tensions.

Experts from Asean Securities predict that the VN-Index may test resistance around 1,380 points in the first week of July. If it breaks through this level, it could target the key psychological threshold of 1,400 points. The 1,350 - 1,370 range is currently acting as a technical buffer following recent corrections.

Starting early July, the market can expect a wave of financial reports from listed companies, with the third week typically being the busiest. Analysts are optimistic about the banking sector's profit outlook, as it holds the largest market capitalisation and profit share.

On the Hanoi Stock Exchange (HNX), the HNX-Index closed Monday at 229.22 points, up 1.41 points, or 0.62 per cent.

During the trading session, 67 million stocks were traded on the northern market, equivalent to a trading value of over VNĐ1.28 trillion.

Foreign investors were net buyers on the southern bourse, net buying nearly VNĐ592 billion. However, they net sold VNĐ37.34 billion on HNX.

Bizhub

|