|

'A good strong start' to Fed’s rate cut cycle

The bumper 50 basis points (bps) interest rate cut announced by the US Federal Reserve at its September meeting may increase the likelihood and pressures of the State Bank of Vietnam (SBV) considering similar policy easing.

The Fed decided to reduce the target range of its Fed Funds Target Rate (FFTR) by 50- basis points to a range of 4.75-5 per cent at its Federal Open Market Committee (FOMC) meeting on September 17-18.

This was a deeper cut than expected and marks, "a good strong start," to the Fed’s rate cut cycle, according to FOMC Chair Powell. The Fed also voted to cut the interest rate paid on reserves (IOER) balances by 50 bps to 4.9 per cent, while keeping the QT unchanged.

The notable changes in the September monetary policy statement (MPS) were the dampening of the labour market outlook, while noting further improvement in the US inflation situation. Most importantly, the FOMC gave a clear signal that the Fed has gained confidence in inflation heading towards a target to start reducing rates to address the labour market concerns.

During the press conference, FOMC chair Powell said, "This cut is a sign of the Fed’s commitment not to get behind the curve in normalising rates," but went on to warn it should not be viewed as a new pace, and that there is no preset path the Fed is following.

"The latest FOMC decision was a surprise versus our more conventional view of a 25-bps rate move amidst a still largely benign economic backdrop and cooling inflation," Suan Teck Kin, head of Research at UOB, said.

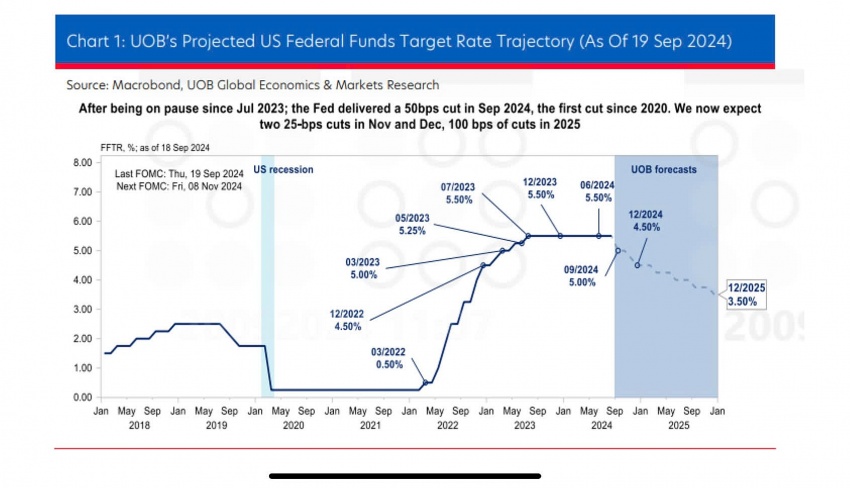

Post-September FOMC, UOB's Research expects the Fed to continue the rate cut cycle in the remaining meetings of 2024, where this team forecasts 50-bps cuts for the remainder of 2024 (two 25-bps cuts, one each on November 24 and December 24 FOMC). This team maintains the expectations of 100 bps of cuts in 2025 (one 25-bps cut per quarter).

"We also note Powell’s guidance that the Fed forecasts, while not a plan, nonetheless provide a good starting point for where policymakers see things are going right now," Suan added.

There is a difference between UOB and the Fed forecasts. UOB's terminal rate is projected at 3.25 per cent, which is expected to be reached by early 2026 versus the Fed’s longer-run view of 2.9 per cent.

"But the Fed has nudged up the longer-run median view of the FFTR in the last two dot plots, so we will not be surprised that it will be lifted further towards a 3 per cent handle in the subsequent reports, thus likely converging towards our terminal rate projection," he said.

How the Fed's rate cut affects Vietnam

Suan said that despite the impact of the typhoon and a notable rebound in the VND exchange rate since July, UOB's research continues to expect the SBV to maintain its key policy rates for the rest of the year, as the central bank keeps an eye on the upside risks on price pressures.

Overall consumption price index (CPI) rose by 4 per cent on year in August, just slightly below the 4.5 per cent target. Upward pressures on prices may be more intense following the disruptions to agricultural output, as food accounts for 34 per cent of CPI weight.

"The SBV is likely to adopt a more targeted approach to support impacted individuals and businesses in their regions, rather than implementing a broad, nationwide tool such as interest rate cuts. Consequently, we anticipate the SBV to maintain its refinancing rate at the current 4.5 per cent while focusing on facilitating loan growth and other support measures," Suan said.

"However, the bumper 50bps interest rate cut announced by the US Federal Reserve at its Sep meeting may increase the likelihood, and pressures, on the SBV to consider similar policy easing," he added.

vir

|