|

Vietnam’s sustainable bonds valued at $800mn in Q1: ADB

Due to the absence of issuance during the first quarter of 2024, the total stock of sustainable bonds in Vietnam contracted 0.5 percent quarter on quarter to a size of US$0.8 billion at the end of March, according to the Asian Development Bank (ADB)’s June Asia Bond Monitor report.

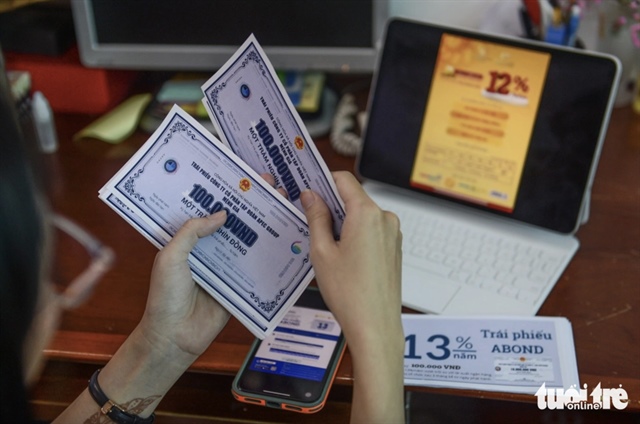

The total stock of sustainable bonds in Vietnam contracted 0.5 percent quarter on quarter to a size of US$0.8 billion at the end of the first quarter of 2024. Photo: Quang Dinh / Tuoi Tre

|

The sustainable bond market in Vietnam comprises green bonds and sustainable bond instruments issued solely by corporates and mostly carrying short-term tenors.

More than half (53.4 percent) of the sustainable bond stock consisted of sustainability bonds carrying maturities of three years or less, and the remaining 46.6 percent were green bonds, about 54 percent of which carried tenors of three years or less.

Foreign-currency-denominated instruments comprised over 70 percent of the economy’s total sustainable bonds at the end of March.

Growth in the nation’s local currency bond market rebounded to 7.7 percent quarter on quarter in the January-March period.

The growth of the local currency bond market was primarily driven by increased government issuance and the State Bank of Vietnam's resumption of central bank bills issuance in March to support the Vietnamese dong.

Treasury and other government bonds, which accounted for the majority of Vietnam’s total debt stock, grew 3.3 percent quarter on quarter between January and March on increased issuance to support the government’s funding requirements.

On the other hand, corporate bonds, which comprised 24.8 percent of the total local currency bond market at the end of March, contracted 0.9 percent quarter on quarter due to a large number of maturities and a low volume of issuance during the quarter.

The report also shows that the Southeast Asian nation’s local currency government bond yields rose for all tenors between March and May.

Bond yields increased an average of 56 basis points due to the United States Federal Reserve’s delay in cutting its policy rate and rising domestic inflation.

Vietnam’s year-on-year consumer price inflation inched up to 4.44 percent in May, driven by elevated energy and pork meat prices, edging closer to the government’s 2024 ceiling of 4.5 percent.

Higher-for-longer interest rates dampened sentiment in Southeast Asia, China, Japan, and South Korea, leading to less issuance in the first quarter of 2024 and a slowdown in the quarter-on-quarter growth of bonds outstanding.

The outstanding stock of sustainable bonds in ASEAN+3 economies totaled $805.9 billion at the end of March.

Despite growth in the ASEAN+3 market, sustainable bonds accounted for only 2.1 percent of the region’s total bonds outstanding at the end of March.

Tuoi Tre News

|